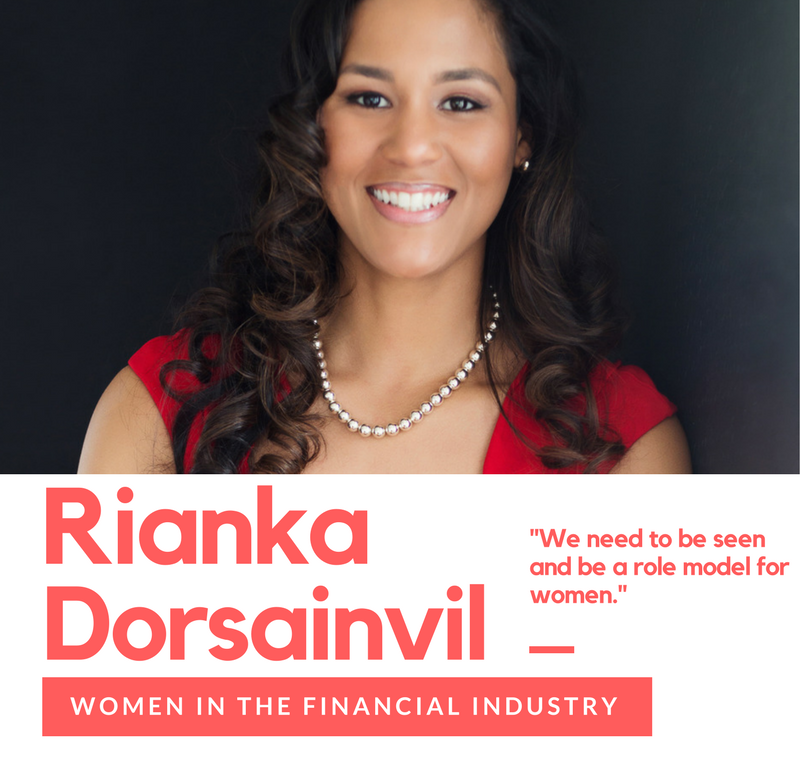

Meet Rianka Dorsainvil.

Rianka Dorsainvil is a Certified Financial Planner® and founder of Your Greatest Contribution, a virtual, fee-only financial planning firm. Rianka has worked with both high-net worth clients, to volunteering and working with low income families. Rianka believes that these experiences have taught her, "the need of working with a financial planner should not be dictated by how much money you have, but the desire and motivation to want to live a fruitful life."

Rianka was recognized by Investment News in their 2015 list of top "40 Under 40" financial services professionals. Furthermore, Rianka was published in the Journal of Financial Planning for her research on the millennial generation's cultural and wealth patterns.

Website: http://yourgreatestcontribution.com/ Twitter: @Rianka_D

I got the opportunity to chat with Rianka and hear her best financial tips, greatest professional achievements, and her thoughts on the reported shortage of women in the financial services industry.

Why did you decide to work in the financial industry?

Growing up, I really didn’t know anything about personal finance; I never knew there was an opportunity to come into this as a career.

I took a personal finance class as an elective in college and that’s where I started learning about 401(k)s, disability insurance, credit scores, credit reports, and I thought: why isn’t this a required course to take? I was blown away by the information I learned in that class. I would learn this personal financial information and want to share it.

At this time, my nana was getting sick, on dialysis and she was still working! During long weekend breaks I would go back home and share the personal finance information with her. It was the first time we had talked about money. When she was young, she didn’t know this information, so she wasn’t financial prepared to retire. I told her I wanted to be her finance resource, so this is how I got into personal finance.

It was, and still is, my passion to educate people.

How long have you worked in the financial industry?

It has been 8 years.

What has been your greatest professional achievement?

My most significant professional achievement has been launching my own business.

From a mentorship perspective, my firm allows me to be an accessible resource to other planners to learn what it takes to run a business.

Another professional achievement would be becoming a mentor. I was inspired to become a mentor after reading a Whitepaper by CFP Board’s Women’s Initiative (WIN), which stated that for the past decade, the number of women with a CFP® designation was only 23%. We need to make a collective effort to do something about this.

For me personally, I don’t just stand back and wait for someone else to do something, I want to be apart of the solution or help find a solution.

After reading that Whitepaper, I contacted two other women from Virginia Tech to start a mentorship program where we pair mentors and mentorees, all women, in the personal finance space for them to have a safe a secure space to have a conversation.

I want to be a part of the solution in recruiting and retaining more women in the profession.

Going off of that, could be the same, but what achievement are you most proud of?

Passing the CFP® exam! I’m definitely proud of the mentorship program, but let it be known that the CFP® exam is a beast.

It took me a couple times to pass the exam, but I did it. Only 75,000 individuals in the USA hold this designation, and I am very proud to be one of them.

How do you define success?

I would say if you have attempted to do something, you fought the fear of failure, and you still pushed through it, then that’s a success.

If you live a life of always fearing failure, then you’ll never step outside your comfort zone and take the road less traveled.

What leader inspires you?

I have a few leaders that inspire me, one is Dr. Ruth Lytton and she’s the CFP® program director at Virginia Tech. Her passion to help students inspires me and she sets the bar so high. The time, dedication, and commitment for her students to be successful are inspiring, and not just her students but alumni, too. Professor Derek Klock is also one of my professors over there and is a team with Dr. Lytton; they definitely care about the students at Virginia Tech.

Laurie A. Belew, CFP® is another person that inspires me. I first met her when I was interning with her firm 8 or 9 years ago. Throughout my internship, she tested and challenged me and in the end I thanked her for it. Here recently, we were on the same national leadership board for two years. She’s no longer my boss or superior, we are colleagues. She’s inspiring to all financial planners.

There is also a group I am in called 7 Sisters of Finance; each of them individually inspires me.

It’s been reported that there’s a shortage of women in the financial services industry. What do you think is the best solution to help encourage women to enter this industry?

I think we can approach this two ways.

1. One of the best solutions is to help with the exposure of this profession, women who are planners need to step up, step out, and be heard. There are little girls and young women out there and if they don’t know what we do then they won’t know what to do. It’s up to us to pave the way for the next generation; we need to be seen and be a role model for women, if not, then we’re invisible.

2. A second solution to this problem is mentoring. One of the best gifts I could give to a financial planner is my ear and my time. I’ve gone through many different things in this profession. If somebody is going through something similar then I want to help them. I’ve been there, especially with passing the CFP® exam. For some people they can’t pass the darn thing! So in summary: mentoring, exposure, and stepping up and stepping out.

What are the most common financial mistakes you see being made?

One of the most common mistakes I see being made are not investing or just being afraid to start investing.

If you have a healthy emergency fund established, saving to your retirement account, then it may be time to start investing.

What I encounter is that people are sitting on so much cash and they don’t know how to invest or they’re scared to invest. I came into this profession in 2008/2009 when people were losing their investments in the market. This has created a lack of trust in investing for many people.

For people sitting on a lot of cash, your best friend is compounding interest; allow your money to grow over time. People haven’t been exposed to how the stock market works; time over time it’s been shown to be the best investment vehicle.

What is your number on financial tip?

My number one financial tip is to establish an emergency fund and have quick access to cash. This is so important because I’ll have conversations like this: “Hey, I have an extra $1,000 and I want to invest.” “Do you have an emergency fund?” “No.” “Okay, well, what if you need the money, the investment is bad, and you take it out and lose money?”

People will turn to their credit card, but they’ll have to pay it back with interest. If you’ve established an emergency fund it gives you so much freedom.

What’s a fun fact most people don’t know about you?

I played the violin for four years growing up. I was pretty good, I made All State, and you only make All State if you’re a good violinist in the orchestra.

I stopped playing in high school because I didn’t want to carry my violin around, I wanted to be cool, and now I wish I would have kept playing.

.jpeg)