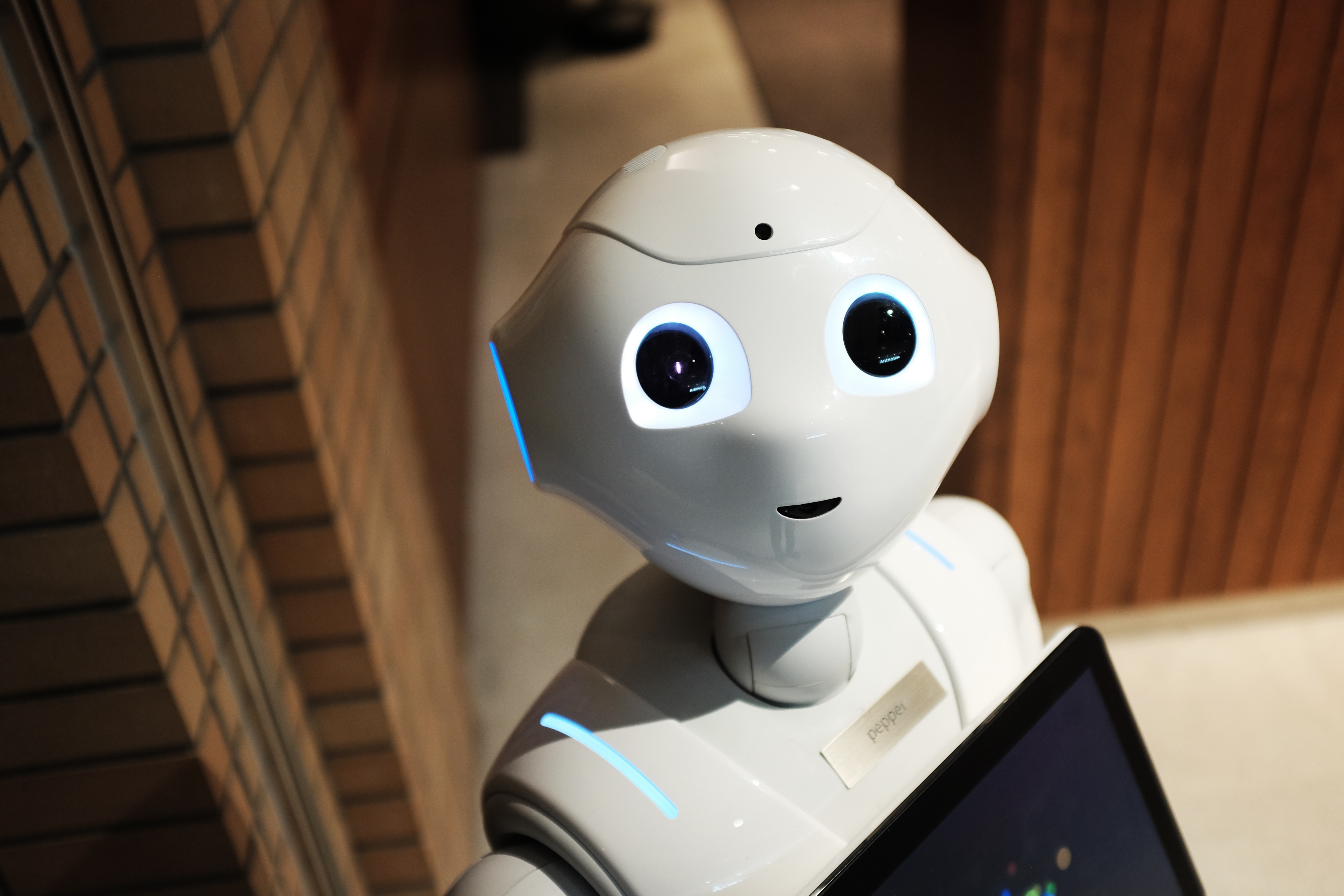

‘Robo Advisors’ are becoming a taboo term among the financial advisor community due to their increase in popularity and complexity; thus creating unsurety about where the profession is going. The younger generation is a large target market for this technology due to its price flexibility and simplicity. There are a number of ways this technology is gaining market share and financial advisors need to become aware to them.

Price Flexibility

Financial advisors have typically set up their businesses to incorporate individuals that own a large amount of assets, normally over $200,000 worth. A reason why robo advisors have pushed on is because they do not discriminate on what type of clients can sign up. Clients with less than $5,000 can create an account, which is an attractant to millenials in particular. The fees that are charged are also different, normally advisors charge a flat rate or a percentage of every investment. Robo advisors’ pricing is a third of the price of the human version.

Simplicity

People don’t like putting their money in others’ hands. Trust is much harder to gain for external sources, especially after a banking crisis that is still fresh for some. Robo-advisors offer an angle that no human being can compete with- no bias. A machine has no ulterior motive when it offers someone an investment idea. This is another aspect of robo-advisors’ popularity, people view their responses as the best possible result based on the data provided. Ease of use is also a huge aspect. The mobile-friendly, on-the-go technology works for busy lives and cuts out the time consuming process of fitting in another person’s schedule.

The Human Upper Hand

Robo advisors are sneaking up but financial advisors still have a tight grip on the industry for now. Registered investment advisors have $5 trillion of assets under their management while robo advisors have stolen $14 billion. This is still a small fraction but enough for the industry to take note of the progress. Robo-advisors don’t have the personal touch or the complexity to tell a family when they can retire based on the mortgage and savings accounts involved in their lives. These robo-advisors can’t necessarily predict a U-turn in the market because most of their decisions are based on ETF’s, which is the downside to the simplicity. It's also not a particularly profitable area with the cost of acquiring a new customer over 3 times the fees collected from them.

![]()

Time to Team up

It may seem like a contradictory way of combating this new movement but the way forward for financial advisors would be to partner up with robo advisors and make them a part of their consulting practice. It could be a route into expanding the client base by offering a service to people who aren’t eligible for the $200,000 bracket or whatever it may be. A lower tier of customers could use this service and grow into a more serious client. Charles Schwab’s Institutional Intelligent Portfolios allow financial advisors to put their brand name on the robo advisor service so it feels like a part of the business.

Whatever way a financial advisor would want to structure the business model, you don’t want clients to choose between you or the robot. The wealth management sector is changing rapidly and it is time for financial advisors to start considering some changes to keep up with this technology.

.jpeg)